Charitable Contribution Mileage Rate 2024

Charitable Contribution Mileage Rate 2024. The internal revenue service (irs) has announced the standard mileage rates for the year 2024. The percentage of your deduction depends on the charitable activity.

The rates are as follows: $7,200 (your 30% limit), or.

$7,200 (Your 30% Limit), Or.

Irs issues standard mileage rates for 2024;

If You Are Itemizing Your Return You Will Enter Them As A Charitable Donations In Donations To Charity In 2023.

The internal revenue service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Unveiling The Irs Mileage Rate For 2024.

Images References :

Source: lonnaqnellie.pages.dev

Source: lonnaqnellie.pages.dev

Charitable Mileage Rate 2024 Kally Marinna, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. The internal revenue service (irs) has announced the standard mileage rates for the year 2024.

Source: michellewidell.pages.dev

Source: michellewidell.pages.dev

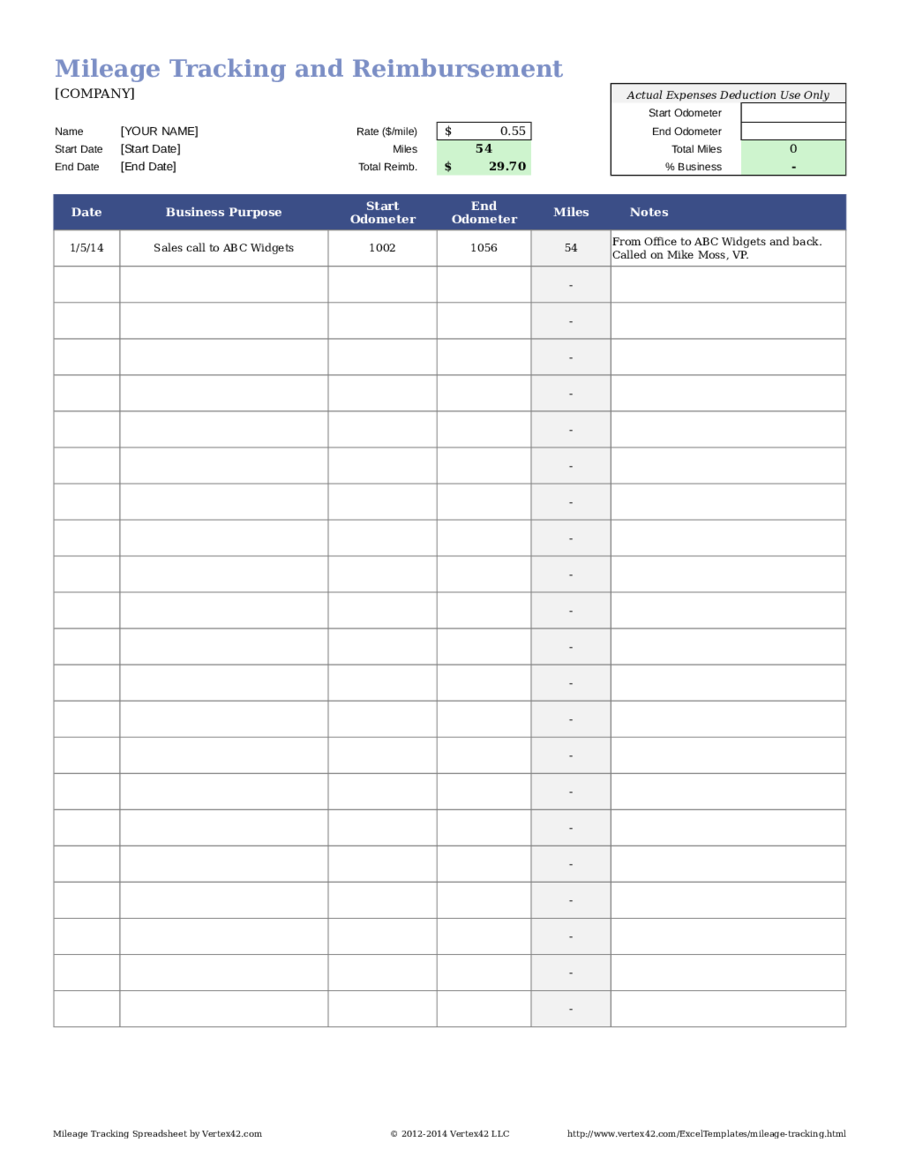

Irs Charitable Mileage Rate 2024 Clair Demeter, Volunteers may also deduct parking fees and tolls—but they should keep accurate odometer. Find standard mileage rates to.

Source: clementinewbrynn.pages.dev

Source: clementinewbrynn.pages.dev

2024 Charitable Contribution Limits Irs Linea Petunia, Misselbeck, cpa, mst, is a tax principal at katz, nannis + solomon. 67 cents per mile driven for business use, up 1.5 cents from 2023.

Source: elliqmarielle.pages.dev

Source: elliqmarielle.pages.dev

Irs Mileage Reimbursement Rate 2024 Fanya Jemimah, The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. 17 rows page last reviewed or updated:

Source: kara-lynnwmamie.pages.dev

Source: kara-lynnwmamie.pages.dev

2024 Gsa Mileage Reimbursement Rate Elnora Frannie, Start saving more on your taxes and give with daffy. The taxact ® program computes the charitable mileage deduction for you, per the irs standard mileage rates webpage.

Source: imagetou.com

Source: imagetou.com

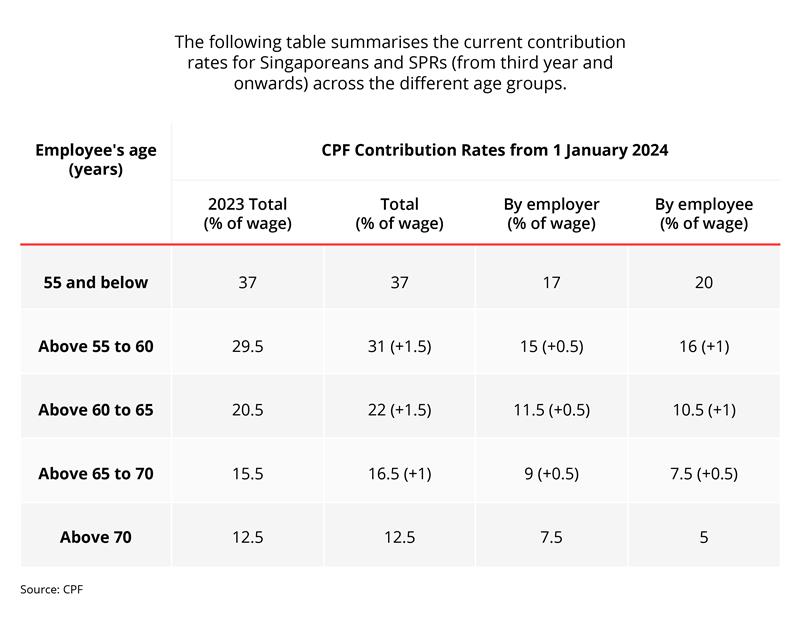

Cpf Contribution Rate 2024 Calculator Image to u, The internal revenue service (irs) has announced the standard mileage rates for the year 2024. Specifically, you can deduct charitable contributions of 20% to 60% of your adjusted gross income (agi).

Source: fiannqshanie.pages.dev

Source: fiannqshanie.pages.dev

2024 Charitable Contribution Limits Dredi Ginelle, The rates are as follows: For 2024, the business mileage rate is 67 cents per mile.

Source: robynbloralyn.pages.dev

Source: robynbloralyn.pages.dev

Hsa Contribution Max For 2024 Mufi Queenie, The standard mileage rate for business will be 67 cents per mile, effective jan. Find standard mileage rates to.

Source: marysawkassi.pages.dev

Source: marysawkassi.pages.dev

401k Contribution Limits 2024 Catch Up Over 50 Dacy Rosana, 67 cents per mile driven for business use, up 1.5 cents from 2023. The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Standard mileage rates for 2024; April 4, 2024 2:31 pm.

The Internal Revenue Service (Irs) Has Announced The Standard Mileage Rates For The Year 2024.

these figures are pivotal for nonprofits, as adhering to them allows organizations to reimburse their staff and.

The Contribution Is Deductible If Made To, Or For The Use Of, A Qualified Organization.

Volunteers may also deduct parking fees and tolls—but they should keep accurate odometer.